Journey insurance coverage is a type of stuff you hope you’ll by no means want—however whenever you do, it may prevent from a monetary nightmare. Whether or not it’s flight delays, baggage delays, journey cancellation or interruption, and even medical emergencies overseas, having the proper bank card protection could make all of the distinction.

Nevertheless, a standard perception is that bank card journey insurance coverage solely applies should you pay for the journey in full utilizing that card. However what should you’re utilizing factors and miles? Do you continue to get protection on an award ticket?

The brief reply: it is determined by the cardboard and the kind of insurance coverage. Some advantages like emergency medical protection apply robotically, whereas others require you to cost at the very least a part of the journey to your card.

Let’s take a better take a look at bank cards that provide insurance coverage for award journey.

Emergency Medical Insurance coverage: Simply By Being a Cardholder

One of many greatest perks of premium journey bank cards is emergency medical insurance coverage. The excellent news? You don’t must pay to your journey with the cardboard for this protection to use.

Most bank cards that provide emergency medical insurance coverage cowl you just by being an lively cardholder and travelling outdoors your province or territory of residence. The protection usually applies for journeys as much as a set variety of days—often 15–25 days for these beneath 65, and considerably fewer for older travellers.

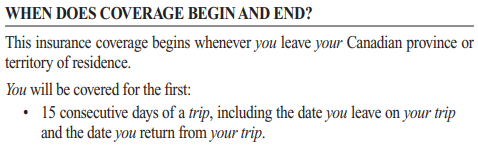

For instance, the Amex Platinum Card’s insurance coverage pamphlet states that it offers emergency medical protection for journeys as much as 15 days if beneath 65.

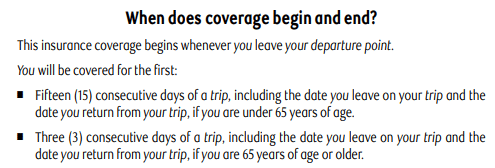

The RBC Avion Visa Infinite’s pamphlet says that it covers cardholders for 15 days for if beneath 65, and three days if 65 or older.

And the Scotiabank Passport™ Visa Infinite* Card’s advantages booklet states that it gives 25 days of protection if beneath 65, and three days if 65 or older.

As you may see, travelling outdoors of your province or territory of residence is all that’s required for the emergency medical insurance coverage to kick in, and there’s no requirement for the journey’s prices to be charged to the cardboard itself.

That is the case for nearly each card on the market that features medical insurance coverage, together with the American Categorical Gold Rewards Card, the American Categorical® Cobalt® Card, the CIBC Aventura® Visa Infinite* Card, and the WestJet RBC® World Elite Mastercard‡, amongst others.

Which means that regardless of the way you booked your journey—whether or not you paid money, used Aeroplan factors, or stitched collectively a multi-airline journey utilizing numerous rewards—you’re nonetheless lined for medical emergencies, so long as you retain considered one of these premium journey bank card open.

That stated, be sure to rigorously learn the insurance coverage pamphlet in your bank card, since there are all the time sure exclusions to which the medical protection wouldn’t apply. Most frequently, preexisting medical situations or endeavor dangerous actions will void the protection.

Furthermore, notice that the protection usually solely lasts for a sure variety of days in your journey, so you should still have to buy further insurance coverage should you’re travelling for an extended period. You are able to do this by topping-up your bank card protection or buying a coverage from a separate supplier.

Different Forms of Journey Insurance coverage: Use the Proper Credit score Card

Now, whereas most premium bank cards present journey medical insurance coverage to their cardholders no matter whether or not the journey was billed to the cardboard, the identical generosity is often not prolonged to different forms of insurance coverage.

To be eligible for protection for flight delays, baggage delays, journey cancellation & interruption, or journey accident insurance coverage, you’ll almost definitely have to have booked the journey and paid at the very least 75% of the portion with the bank card. This may be a difficulty for anybody who primarily travels on award tickets, as a flight that’s paid for with miles can’t actually be charged “in full” to any card in any respect.

Fortunately, that’s the place a number of choose bank cards in the marketplace can fill the hole.

Aeroplan Co-Branded Credit score Playing cards

Aeroplan co-branded bank cards lengthen journey insurance coverage advantages to any journeys booked utilizing Aeroplan factors, so long as the related taxes and costs are billed to the cardboard.

There are at present 11 Aeroplan co-branded bank cards obtainable in Canada, issued by TD, CIBC, and American Categorical.

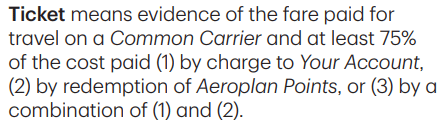

For instance, right here’s what the TD® Aeroplan® Visa Infinite* Card’s insurance coverage bundle has to say about ticket eligibility for flight delay, delayed and misplaced baggage, journey cancellation and journey interruption, and customary service accidents:

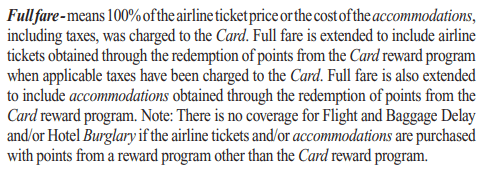

And right here’s the equal language on the American Categorical Aeroplan Reserve Card‘s insurance coverage pamphlet:

As you may see, the insurance coverage advantages on these playing cards will apply regardless of whether or not you charged the total fare to the cardboard, redeemed Aeroplan factors for the ticket and charged the taxes and costs to your bank card, or redeemed a hybrid quantity of Aeroplan factors and money utilizing the Factors + Money function.

Subsequently, whether or not you’re redeeming Aeroplan factors for a fast one-way flight or a fancy journey and also you need to benefit from the full insurance coverage safety of a premium journey bank card in your journey, then it’s greatest to place the taxes and costs onto considered one of Amex, TD, or CIBC’s Aeroplan-affiliated playing cards.

And should you usually journey on Aeroplan factors, you would possibly discover it worthwhile to repeatedly preserve considered one of these playing cards open for the aim of giving your self some peace of thoughts alongside your points-funded journeys.

Credit score Playing cards with Different Loyalty Applications

Most Canadian bank cards which have a loyalty program related to them will usually lengthen their insurance coverage advantages to journey booked via that particular factors program as properly. A couple of examples are as follows:

Subsequently, everytime you’re trying to redeem one of many main Canadian factors currencies for a flight, you’ll often have the ability to make the most of the insurance coverage perks on no matter bank card is related to that factors program (which might be the cardboard that you just had used to earn the factors to start with).

And if that plan doesn’t work out for some motive, you may all the time cost the remaining stability to a different card as a fallback choice…

A Credit score Card That Covers All Reward Bookings

In Canada, the Nationwide Financial institution® World Elite®Mastercard® is the lone bank card that covers all reward bookings.

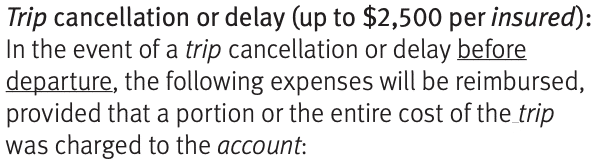

The insurance coverage protection for the Nationwide Financial institution® World Elite® Mastercard® doesn’t mandate that the full value of the journey be charged to the cardboard, however slightly solely requires {that a} “portion or your entire value of the journey” is charged to be adequate for protection.

Which means that everytime you’re redeeming any sort of rewards currencies for a flight, be it with Aeroplan factors, Cathay Pacific Asia Miles, Atmos Reward, Air France/KLM Flying Blue miles, or Ethiopian Airways ShebaMiles, you’ll be eligible for insurance coverage protection with the Nationwide Financial institution® World Elite® Mastercard®, because you’re fulfilling the criterion of “partial value” in doing so.

This card’s far-reaching insurance coverage proposition is without doubt one of the explanation why you would possibly want to choose it up and/or maintain onto it in the long run.

Conclusion

For those who primarily journey on factors, you don’t must sacrifice insurance coverage safety—you simply want the proper bank card.

Emergency medical insurance coverage is mostly lively so long as you’re touring out-of-province and your card account is in good standing. In the meantime, utilizing a co-branded bank card via TD, CIBC, American Categorical, or RBC can often deal with the remaining forms of protection.

For many who need the final word peace of thoughts, the Nationwide Financial institution® World Elite® Mastercard® stands out as your best option, providing insurance coverage safety on any award reserving, whatever the loyalty program used.

Whether or not you’re a seasoned factors collector or simply getting began, ensuring you might have the proper bank card in your pockets can assist guarantee your travels go easily, even when the sudden occurs.