The Cathay World Elite® Mastercard® – powered by Neo is the one bank card in Canada that instantly earns Cathay Pacific Asia Miles by means of its welcome supply and on on a regular basis spending.

Asia Miles gives members entry to one of the best award availability for Cathay Pacific flights, in addition to precious redemptions on oneworld-member airways.

Let’s check out the the reason why you would possibly take into account the Cathay World Elite® Mastercard® – powered by Neo, in addition to the way it stacks up in comparison with different playing cards within the Canadian market.

|

Supplementary cardholders: |

|

|

$80,000 (private), $150,000 (family) |

|

What we love: robust welcome bonus, 15% low cost on Cathay Pacific flights, World Elite Mastercard advantages. What we’d change: enhance class incomes charges, embrace airline-specific advantages.

Welcome Bonus

One of the crucial essential issues to contemplate when making use of for a bank card is the energy of the welcome supply. It’s additionally price contemplating how straightforward it’s to meet the minimal spending necessities, as you must work a lot more durable with some playing cards than others.

Since its launch in December 2023, the Cathay World Elite® Mastercard® – powered by Neo has a welcome gives of 27,000–60,000 Asia Miles.

Fortuitously, all gives have had comparatively low minimal spending necessities of $3,000–5,000 within the first three months, and the factors from the welcome bonus have all the time been awarded in full through the first yr.

Cathay World Elite® Mastercard® – powered by Neo

- Earn 35,000 Asia Miles upon card activation†

- Plus, earn 25,000 Asia Miles upon spending $5,000 within the first three months†

- Then, earn 4 Asia Miles per greenback spent on Cathay Pacific flights†

- And, earn extra Asia Miles at Neo’s companions†

- Take pleasure in a 15% low cost on Cathay Pacific flights†

- Minimal revenue: $80,000 (private), $150,000 (family)

- Annual payment: $180

We worth Asia Miles at 1.6 cents per mile, and utilizing this valuation, we worth a welcome bonus of 27,000 Asia Miles at $432 and a welcome bonus of 60,000 Asia Miles (the cardboard’s all-time excessive) at $960.

Relying on the way you select to redeem these miles, the worth may find yourself being price kind of than these figures. Count on a better return for journey in premium cabins, and near par for redemptions in economic system.

Incomes Charges

With the Cathay World Elite® Mastercard® – powered by Neo , you earn Asia Miles on the following charges:

- 4 Asia Miles per greenback spent on eligible Cathay Pacific purchases

- 2 Asia Miles per greenback spent on all eligible international foreign money purchases

- 1 Asia Mile per greenback spent on all different eligible purchases

As soon as once more, utilizing our valuation of 1.6 cents per Asia Mile, you’re taking a look at an efficient return of 6.4% on Cathay Pacific purchases, 3.2% on eligible international foreign money purchases, and 1.6% on all different eligible purchases.

The return on Cathay Pacific purchases is superb, and in the event you’re a frequent flyer with the airline, you’ll be getting an important return in miles to your purchases.

The elevated Asia Miles you obtain on international foreign money purchases outdoors Canada is offset by the two.5% international transaction payment you must pay on those self same bills. For out-of-country bills, you can be higher off utilizing a bank card that doesn’t levy international transaction charges.

The baseline incomes fee of 1 Asia Mile per greenback spent and its efficient 1.6% return is sweet, however there are additionally different playing cards to contemplate that supply a better baseline return.

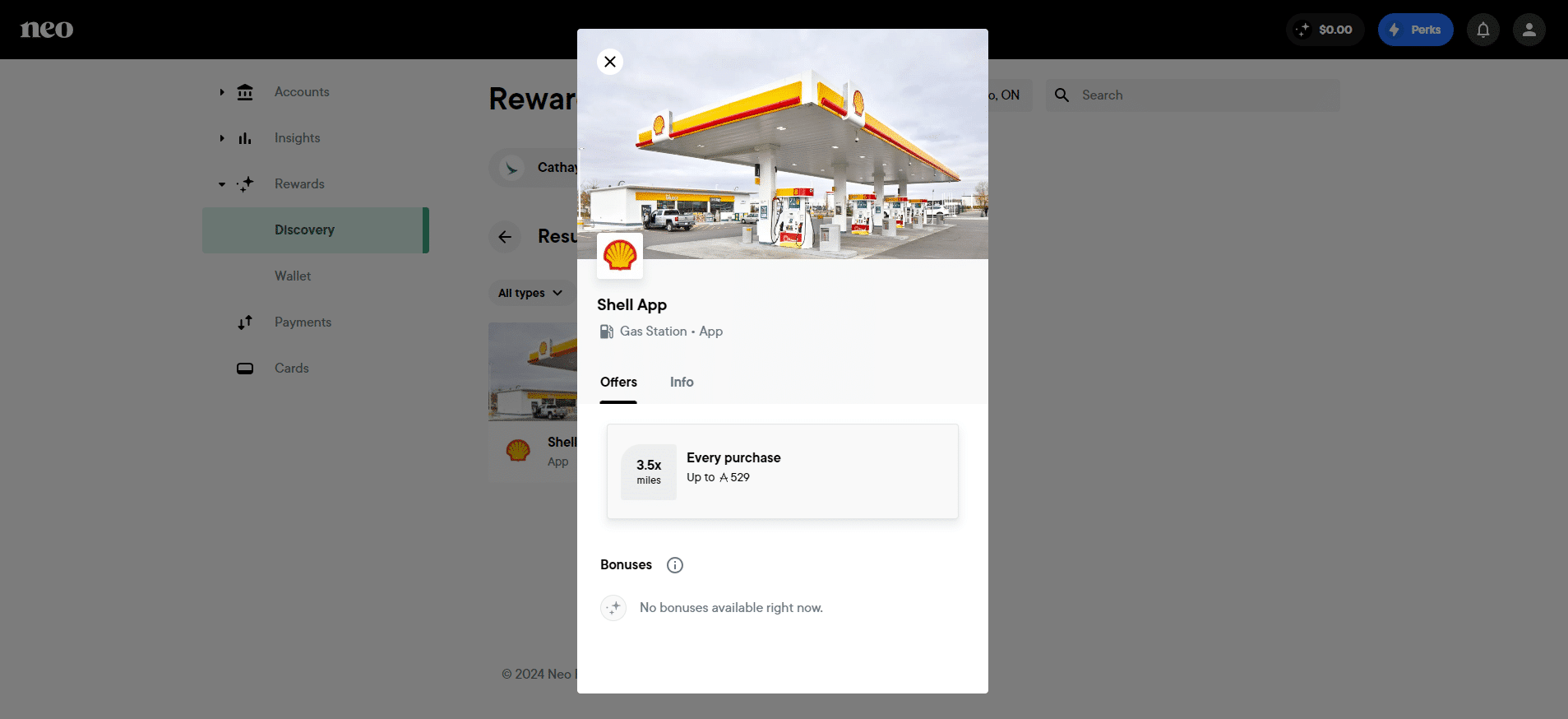

Along with the above incomes charges, the Cathay World Elite® Mastercard® – powered by Neo has unique companions with which you earn considerably increased Asia Miles for each greenback spent.

Should you store at considered one of Neo’s many companions, the Cathay World Elite® Mastercard® – powered by Neo instantly turns into extra precious.

Sadly, the listing of companions isn’t made public till after you’ve utilized for the cardboard, and the companions listing is pretty restricted and comes with spending restrictions.

Redeeming Asia Miles

You may redeem your Asia Miles for award flights with Cathay Pacific and its associate airways, together with oneworld airways like British Airways, Qatar Airways, Japan Airways, and extra.

In the previous couple of years, Asia Miles has gone by means of a few devaluations, with some being extra important than others.

Nonetheless, there’s loads of worth to be present in this system, particularly in the event you prioritize journey with Cathay Pacific. That’s since you’ll discover one of the best (and within the case of premium cabins, the one) award availability on Cathay Pacific flights with Asia Miles.

In Canada, Cathay Pacific gives continuous flights from Hong Kong to Vancouver and Toronto.

One-way redemptions between Hong Kong and Vancouver worth out as follows, with a modest quantity of taxes and costs:

- Financial system: 27,000 Asia Miles

- Premium economic system: 50,000 Asia Miles

- Enterprise class: 88,000 Asia Miles

Whereas one-way redemptions between Hong Kong and Toronto worth out as follows:

- Financial system: 38,000 Asia Miles

- Premium economic system: 75,000 Asia Miles

- Enterprise class: 115,000 Asia Miles

Exterior of those routes, listed below are some examples of what you are able to do when you’ve amassed a wholesome sum of Asia Miles:

- Fly Cathay Pacific First Class from Hong Kong to Beijing for 43,000 Asia Miles

- Fly Cathay Pacific First Class from Hong Kong to Tokyo for 50,000 Asia Miles

- Fly British Airways enterprise class from North America to London for 63,000 Asia Miles

- Fly American Airways enterprise class from the US to Australia for 89,000 Asia Miles

- Fly Cathay Pacific First Class from Hong Kong to London or Los Angeles for 125,000 Asia Miles

- Fly Japan Airways First Class from Tokyo to New York for 135,000 Asia Miles

Insurance coverage Protection

With the Cathay World Elite® Mastercard® – powered by Neo, you obtain the next insurance coverage advantages:

- Emergency medical insurance coverage: as much as $1 million for journeys of as much as 14 days for these aged 60 and youthful

- Journey interruption insurance coverage: as much as $1,000 per individual, as much as $5,000 per journey

- Journey cancellation insurance coverage: as much as $1,000 per individual, as much as $5,000 per journey

- Flight delay insurance coverage: as much as $500 ($250 per day for affordable and obligatory bills for a missed connection, denied boarding, or flight departure delay).

- Misplaced/delayed baggage insurance coverage: as much as $1,000 for delays of six hours or longer

- Auto rental collision/harm insurance coverage: for as much as 48 consecutive days on autos with an MSRP of as much as $65,000

- Lodge/motel housebreaking insurance coverage: as much as $1,000 to cowl the harm to or the lack of private gadgets ensuing from the housebreaking at your lodge or motel room

- Buy safety: for up 90 days from date of buy

- Prolonged guarantee: doubling the producer’s guarantee, as much as one extra yr

For a journey bank card with a $180 annual payment, the journey and retail insurance coverage protection on the Cathay World Elite® Mastercard® – powered by Neo isn’t fairly as robust as we’d like.

For instance, the emergency medical insurance coverage of as much as $1 million solely covers cardholders aged 60 and youthful for 14 days.

There are different bank cards with decrease annual charges that supply extra safety, longer protection, and embrace advantages for these as much as 65 years of age.

The Cathay World Elite® Mastercard® – powered by Neo additionally doesn’t present cellular gadget insurance coverage, which is often seen on comparable journey playing cards with an equal, or perhaps a decrease, annual payment.

Lastly, quite a lot of co-branded airline bank cards will cowl you for flight-related insurance coverage protection on award bookings with the airline. The Cathay World Elite® Mastercard® – powered by Neo doesn’t.

Typically talking, once you pay for an award reserving with a co-branded bank card that earns the factors/miles you earn with the cardboard, the insurance coverage protection applies.

For instance, in the event you pay for the taxes and costs on an Aeroplan reserving with an Aeroplan co-branded bank card, or a Flying Blue reserving with the Air France KLM World Elite Mastercard, you’re coated the identical as in the event you’d booked the flight with money.

Sadly, this isn’t the case with the Cathay World Elite® Mastercard® – powered by Neo.

For insurance coverage protection on an Asia Miles award reserving, you’re higher off paying for the taxes and costs with a distinct bank card, such because the Nationwide Financial institution® World Elite® Mastercard®, since you’re then coated for insurance coverage in your journey.

In any other case, the journey insurance coverage advantages supplied by the cardboard are pretty typical for a World Elite Mastercard.

Different Options

Probably the most noteworthy distinctive profit on the Cathay World Elite® Mastercard® – powered by Neo is the supply of 15% off the bottom fare once you make a money reserving by means of the Cathay Pacific web site and use your Cathay World Elite® Mastercard® – powered by Neo with a promo code listed on the Cathay Pacific web site to make an eligible buy.

This profit is simply out there till December 31, 2025 (although it appears to get renewed yearly), and solely covers one-way or round-trip flights departing from Canada. The complete listing of phrases and situations will be discovered on the Cathay Pacific web site.

With the Cathay World Elite® Mastercard® – powered by Neo, you additionally obtain commonplace World Elite® Mastercard® perks, together with paid lounge entry by means of Mastercard Journey Cross, powered by DragonPass.

In any other case, the Cathay World Elite® Mastercard® – powered by Neo lacks airline-specific advantages. Notably, there are not any distinctive advantages for Cathay Pacific flights supplied to cardholders except for the low cost.

Whereas Neo advertises this card as coming “unique membership perks” comparable to on-line precedence check-in, further baggage redemption, and Cathay Pacific enterprise class lounge redemption entry, the truth is that these are merely advantages loved by all base-level Asia Miles members.

In the case of further baggage and Cathay Pacific enterprise lounge redemptions, this merely means that you’ve got the choice to redeem Asia Miles for these perks, which once more is one thing that anybody with an Asia Miles membership can select to do.

Different Playing cards to Take into account

The Cathay World Elite® Mastercard® – powered by Neo is price getting if you’d like a pleasant enhance to your Asia Miles stability, you can also make good use of the 15% low cost, and/otherwise you store on the Neo companions that earn elevated Asia Miles with this card.

Nevertheless, in the event you’d wish to discover a bank card that earns airline miles, there are different choices that provide you with extra flexibility or that earn Asia Miles at a heightened fee.

For instance, the RBC® Avion Visa Infinite† earns RBC Avion factors, which you’ll be able to switch to The British Airways Membership and Cathay Pacific Asia Miles at a 1:1 ratio, in addition to American Airways AAdvantage at a 1:0.7 ratio.

This provides you extra flexibility for award bookings with oneworld airways, since completely different loyalty applications have completely different candy spots. Usually, you possibly can guide the identical flight with a number of applications, however the pricing is likely to be extra beneficial with one over the opposite.

The one draw back to the RBC® Avion Visa Infinite† is that it has somewhat low incomes charges. Nevertheless, in the event you even have an RBC® ION+ Visa – constructing what we wish to confer with as The Optimized RBC Credit score Card Portfolio – you possibly can earn 3x Avion factors on many frequent day by day bills:

- Earn 3 Avion factors† per greenback spent on qualifying grocery, eating, meals supply, gasoline, rideshare, day by day public transit, electrical automobile charging, streaming, digital gaming and digital subscriptions

In different phrases, with The Optimized RBC Credit score Card Portfolio, you possibly can earn 3x Avion factors on the above classes, which is primarily like incomes 3x Asia Miles (since Avion factors switch 1:1 to Asia Miles.)

The Optimized RBC Credit score Card Portfolio

In the meantime, in case your main objective is to build up Asia Miles, you can take into account the American Categorical Cobalt Card which earns American Categorical Membership Rewards (MR) factors that may simply be transformed to Asia Miles at a 1:0.75 ratio. In different phrases, every MR level will be exchanged for 0.75 Asia Miles.

With the American Categorical Cobalt Card, you earn MR factors on the following charges in your purchases:

- 5 MR factors per greenback spent on groceries and eating in Canada (as much as $2,500 monthly)

- 3 MR factors per greenback spent on eligible streaming companies

- 2 MR factors per greenback spent on gasoline, transit, and rideshare in Canada

- 1 MR level per greenback spent on all different purchases

There’s quite a lot of flexibility with Membership Rewards factors, however in the event you intend to transform all of your MR factors to Asia Miles on the fee of 1:0.75, the incomes charges on the Amex Cobalt are primarily as follows:

- 3.75 Asia Miles per greenback spent on groceries and eating in Canada (as much as $2,500 monthly)

- 2.25 Asia Miles per greenback spent on eligible streaming companies

- 1.5 Asia Miles per greenback spent on gasoline, transit, and rideshare in Canada

- 0.75 Asia Miles per greenback spent on all different purchases

As you possibly can see, in most spending classes, you can find yourself incomes virtually 4 occasions as many Asia Miles through the use of your American Categorical Cobalt Card as a substitute of your Cathay World Elite® Mastercard® – powered by Neo.

American Categorical Cobalt Card

- Earn as much as a complete of 15,000 MR factors upon spending $750 in every of the primary 12 months

- Earn 5x MR factors on groceries, eating places, bars, and meals supply

- Earn 3x MR factors on eligible streaming companies

- Earn 2x MR factors on gasoline and transit purchases

- Switch MR factors to Aeroplan, Avios, Flying Blue, Marriott Bonvoy, and extra

- Benefit from the unique advantages of being an American Categorical cardholder

- Bonus MR factors for referring household and pals

- Month-to-month payment: $12.99

Conclusion

The Cathay World Elite® Mastercard® – powered by Neo gives a stable welcome bonus and the distinctive advantage of 15% off Cathay Pacific flights.

Regardless of being the one co-branded Cathay Pacific Asia Miles bank card in Canada, the cardboard doesn’t supply any extra Cathay Pacific perks, and the class incomes charges are comparatively low.

If you can also make use of the advantages that do exist, or in the event you’d like to spice up your Asia Miles stability, then the Cathay World Elite® Mastercard® – powered by Neo deserves consideration – particularly with an all-time excessive supply.

Nevertheless, there are different playing cards to contemplate in the event you’d wish to earn extra versatile factors for journey, or in the event you’d wish to have higher returns on day by day spending.